Find the right business loan

Connect with dozens of certified lenders

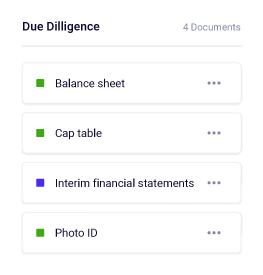

EASY PROCESS

Levr.ai makes it easy to apply for a small business loan

With its easy-to-use dashboard, Levr.ai streamlines application prep. Invite decision makers, accountants and more to review documents and upload financials to get your loan funded—fast.

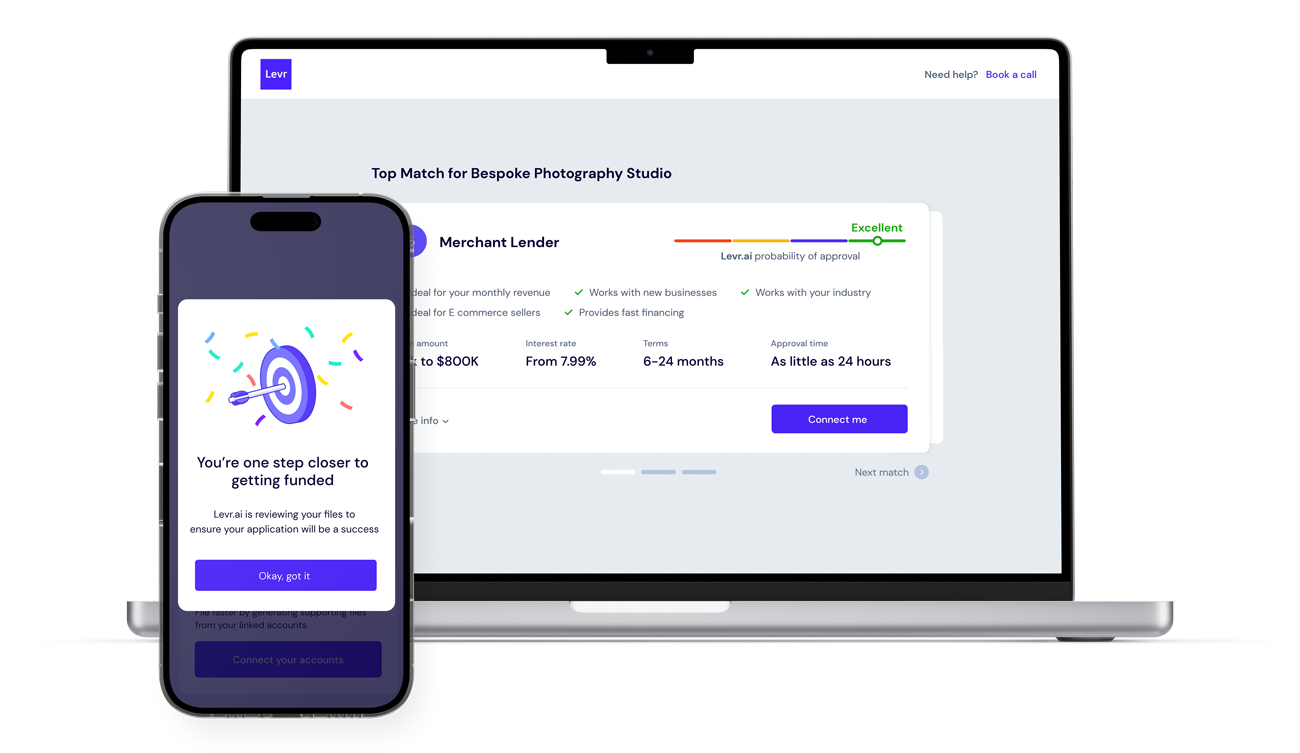

MORE LOAN OPTIONS

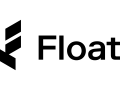

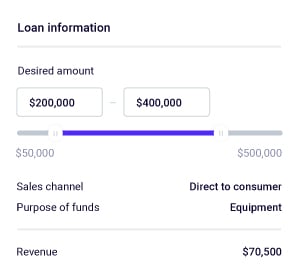

Levr.ai harnesses the power of AI for custom loan options

Levr.ai uses AI to customize loan matches based on your businesses data. You can evaluate and decide what is the right loan option for you and when to engage with lending partners.

BUILT IN SUPPORT

Support & Resources

Levr.ai’s intelligent loans platform comes with free built-in resources. This includes guides, templates and how to optimize the creation of required documents.

Ready to get started?

SUCCESS STORIES

Trusted by both small businesses and high-growth startups

“Levr.ai helped us discover options we didn’t know existed, ensured our documentation was complete, so we could be successful on our first try.”

“Levr.ai made getting our business loan a smooth and quick process. We have big goals for the next year, and Levr.ai successfully helped us secure the right financing our business needs for continued growth.”

CEO & Co-founder

“The process from start to finish exceeded expectations. We had a bunch of loan options to consider thanks to Levr.ai, in tandem their ability to organize our documentation and application made all the difference in our fast approval.”

CEO & Co-founder

GUIDES & ARTICLES

The expertise you need to help your business grow

This is why we’ve built Levr.ai—to help you. View our extensive library and get personalized help and suggestions inside the Levr.ai app.

Small business loan common FAQs

Levr.ai is an easy, fast and free online small business loans platform for business owners to find the right small business loan.

Levr.ai guides you through the entire loan application process to help you get loans for small businesses. Once you share a bit of information about your small business, Levr.ai powered by artificial intelligence (AI) and machine learning (ML) will customize and match you with top lenders for the online funding you need. Levr.ai takes into consideration the lender, terms and affordability for a new small business loan with suggested matches to better meet your small businesses' financial needs.

Levr.ai has a team of lender experts with 10+ years banking experience with loans for small business to assist with organizing the key financial documentation required for a strong new small business loan application. With the help of Levr.ai’s guides, tools, and templates, borrowers can streamline the creation of applications in a safe and secure environment.

Levr.ai is a venture-backed high-growth fintech business. Our priority is to build an app that drives value and helps small businesses getting a loan online.

When Levr.ai matches owners with a loan for small business (or lender), and the right online small business loan is funded, a commission is paid by the lender to Levr.ai.

The founding team has decades of combined experience helping new small businesses grow and get secured and unsecured loans online. Experience in small business banking as well as building some of the most powerful apps used by small businesses around the world. This experience, and knowing the small business loan journey can be better, is what powers Levr.ai's mission.

Levr.ai is a free intelligent online loans platform that helps businesses gain better access to online small business loan options. Not a free-trial for a few days or weeks, Levr.ai is free—plain and simple.

Loan for small businesses are important as they serve as a vital lifeline for entrepreneurs aiming to establish or expand their existing or new small business. Both secured and unsecured business loans offer the necessary capital to fuel growth, innovation, and sustainability.

Levr.ai helps by providing small business owners more access to online loans and lenders to empower owners to transform their ideas into thriving enterprises.

Whether it's funding for required equipment, inventory, or operational costs, online small business loans ensure that entrepreneurs have the means to seize opportunities and overcome challenges. With favorable interest rates and flexible repayment terms, getting a small business loans enables owners to invest strategically, hire skilled professionals with the right requirements, and pursue their long-term goals.

Ultimately, new small business loans online serve as catalysts for economic development, fostering job creation and driving local economies forward.

Organizing strong new small business loans requirements and applications can be challenging, but with the right requirements, approach and preparation, it becomes easy to start and more manageable to organize. You've come to the right place because Levr.ai is designed to help small business owners get a business loan, whether it’s secured or unsecured.

It's important to thoroughly understand the loan requirements of any new business loans application and gather all the necessary documentation, such as financial statements, business plans, and tax returns. It's recommended that you clearly outline your small business's purpose, goals, and how the loan will be utilized to support business growth or address the specific needs of your small business.

Providing accurate loan requirements and detailed financial information, including cash flow projection requirements and collateral if required, demonstrates your business's ability to repay the new business loan. It can also be helpful to seek guidance from professionals, such as accountants or business advisors, who can assist in structuring a compelling new loan application. By investing time and effort in organizing a strong loan application (or working with Levr.ai), you enhance your chances of getting a business loan you need.

Small businesses can utilize capital in various ways to foster growth and expansion. Here are some of the most common ways small businesses get a business loan.

One of the most popular reasons is to increase inventory. With additional capital, new small businesses can purchase more inventory, ensuring they have enough products to meet customer demand. Purchasing more inventory at once can also help small business owners secure better cost per unit prices increasing overall margin on total sales. In line with growth, investing in marketing and advertising is another common reason we see small businesses seeking loans. When small businesses allocate capital towards marketing efforts it can help small businesses reach a wider audience, increase brand visibility, and attract new customers driving overall profits for the business (even with the extra cost of small business loans borrowing).

Not as common, but often another reason small businesses leverage online loans is to upgrade equipment and technology. Investing in new or upgrading equipment or upgrading can enhance operational efficiency, improve product quality, and enable businesses to offer new services. This can lead to increased productivity and more revenue. Sometimes, small businesses are looking to invest in hiring and training employees. Capital can be used to recruit talented individuals, expand workforce, and provide required training programs.

Another common use of capital is to use a loan to buy a business or start business locations. With sufficient capital, business starts to open new branches, expand existing facilities, or lease larger offices. This enables them to reach new markets, serve a larger customer base, and establish a stronger presence in the industry.

It's important for new small businesses to evaluate their specific needs and develop a growth strategy that aligns with their industry, target market, and long-term goals. Levr.ai's all in one platform and newly created document room makes it easy to organize all your finances and start loan applications outlining all the reasons more capital can help grow your small business.

The online loans business plays a crucial role in supporting the productivity and growth of the small business sector in the buying economy. The online loans business provides new small business loans with more access, allowing entrepreneurs to buy and invest in various areas that enhance productivity and explore new markets. The loans business allows these investments to contribute to improved operational efficiency, increased output, and enhanced competitiveness for small businesses.

Small business loans enable businesses to overcome financial obstacles and seize opportunities that may arise. Whether it's covering short-term cash flow gaps, buying and managing inventory, or investing in research and development, these loans provide the necessary capital to start to navigate challenges and fuel growth.

Commonly the economy depends on loans for businesses to start and stimulate job creation and foster economic development. As small businesses buy, expand and thrive with the help of new small business loans online, they create employment opportunities, contributing to local economies and overall economic growth. The growth of small businesses also leads to increased consumer buying and spending, supplier activity, and tax revenues, benefiting the wider economy.

Yes! Levr.ai can get a business loan for new businesses. However, Levr.ai (at this time) doesn't work with pre-revenue startups. Ideally your business (new or otherwise) must have established some kind of gross sales revenue. When you're a new business and looking to apply for a small business loan, here's some important items to have organized.

It's critical for new small businesses to start or have a clear business plan, outlining the business's mission, objectives, target market, competitive landscape, and growth strategy. The plan should also include financial projections, demonstrating how the small business loan will be utilized and repaid.

Up to date financial documentation, including income statements, balance sheets, and tax returns. These documents provide insights into the financial health and stability of the small business. Levr.ai makes this step easy with our easy to use accounting and banking API connections.

A cash flow statement analysis especially when you're a new small business, as lenders like to see that your small business has a steady and positive cash flow. Easily demonstrating through financial documentation your understanding of the business's cash flow dynamics, including revenue streams, expenses, and projections, is also vital.

When you're a new business it can be hard to have established a business credit score, but having a strong personal credit history is often leveraged and essential. Lenders can assess the personal creditworthiness of small business owners when evaluating small business loan applications. If you can organize some kind of collateral or guarantees, such as existing small business assets or personal assets, this can provide additional security to lenders.

By addressing these key factors, new small businesses can improve their chances of obtaining a small business loan and gaining the necessary financial support to launch and grow their ventures.

Levr.ai's platform is especially designed to help new small businesses secure the financial capital needed to grow. Why? Levr.ai partners with dozens of certified lenders outside of what small business owners are likely to be offered by a typical charter bank. Levr.ai gives new small businesses options they may not realize they have!

Levr.ai is a free, and easy to use platform to make getting a small business loan better. Our team of experts work with the lenders and loan selections to make getting a small business loan your business needs fast.

What you get with Levr.ai— our amazing Lender marketplace that uses an intelligent algorithm that works at finding you the right loan, everyday. Streamlined Document Room, one place to find all your financial documents, at the ready for future applications. As well as a Help center with guides and templates, regularly refreshed, to start your business loan journey.

Additionally, another free resource is our lender expert team with over 10 years of banking experience. Book a free call here.

While we're actively building the best loans experience on Levr.ai, we also have a pretty great Blog that discusses a lot of common topics and questions about getting funding for your small business.